ARTIFICIAL INTELLIGENCE AND REAL INTELLIGENCE: WHY FINANCIAL PLANNING STILL NEEDS A HUMAN TOUCH

If you’ve turned on the news, opened a browser, or listened to your teenager explain homework lately, you’ve heard about artificial intelligence. AI can write emails, analyze mountains of data in seconds, and even suggest what movie you should watch tonight (which it still gets wrong far too often). Naturally, many people are now wondering: Can AI replace my financial planner?

Short answer: no.

Longer answer: absolutely not—and here’s why.

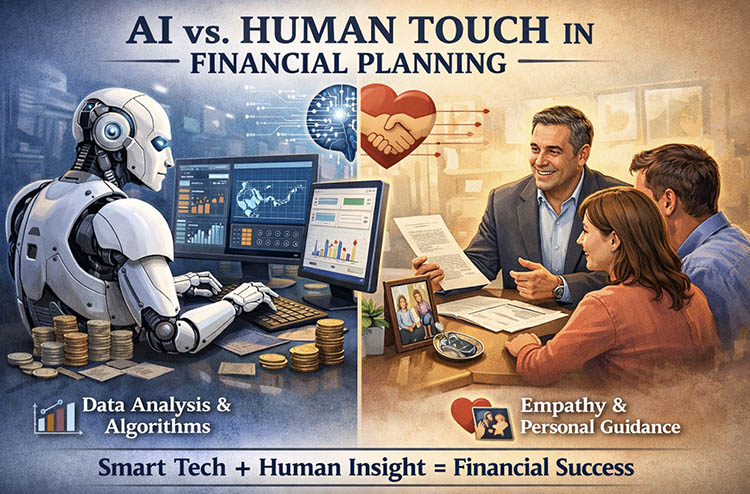

AI is incredibly good at one thing: analyzing data. Give it numbers, rules, probabilities, and historical trends, and it will work tirelessly, never complain, and never need coffee. In financial planning, that’s a powerful tool. AI can help model scenarios, stress-test portfolios, optimize tax strategies, and quickly identify patterns that might take a human much longer to uncover.

But financial planning has never been just about data.

A Certified Financial Planner doesn’t simply plug numbers into software and hit “generate plan.” A CFP knows the story behind the numbers. Your values, your fears, your family dynamics, your health concerns, your career uncertainty, your aging parents, your adult children who may or may not ever leave the payroll—those things don’t fit neatly into a data field.

Even if they could, not everything that matters can be fully or accurately articulated, let alone uploaded into an app. A CFP notices the hesitation in your voice when you talk about retiring. A CFP remembers that you grew up watching a parent struggle financially and that risk feels different to you because of it. AI doesn’t pick up on body language, tone, or the unspoken subtext that often drives financial decisions.

Then there’s behavior—arguably the most important factor in building long-term wealth.

AI can suggest a perfectly logical solution. It cannot help you stick to it when markets fall, headlines scream, and your emotions are doing somersaults. It cannot talk you off the ledge when fear or overconfidence threatens to derail a well-constructed plan. AI doesn’t coach, reassure, challenge, or gently remind you why you made certain decisions in the first place. Humans do.

That doesn’t mean AI has no place in financial planning. Quite the opposite.

The best CFPs are embracing AI as a tool—not a replacement. Used responsibly, AI allows planners to work more efficiently, analyze information more deeply, and spend less time crunching numbers and more time doing what matters most: understanding clients and guiding them through complex decisions. When implemented carefully, with strong data security and privacy safeguards, AI enhances the planning process rather than diminishing it.

Think of AI as the most advanced calculator ever created. It can run thousands of scenarios in seconds, spot inefficiencies, and flag opportunities a human might miss. But it doesn’t decide which goals matter most, when to adjust course, or why one trade-off feels acceptable while another doesn’t. It processes information brilliantly; it doesn’t exercise judgment, empathy, or accountability. In financial planning, those human elements aren’t optional—they’re essential. As we move further into a technology-driven world, the value of working with a Certified Financial Planner who thoughtfully and safely integrates AI will only grow. Not someone who hands decisions over to an algorithm, but someone who uses technology to support human judgment, wisdom, and accountability.

After all, financial planning isn’t just about making smart decisions. It’s about making smart decisions and actually following through. And no matter how advanced AI becomes, it still can’t look you in the eye and say, “I know this feels uncomfortable—but this is the right move for you.”

That’s real intelligence.